43 what is the coupon rate of a bond

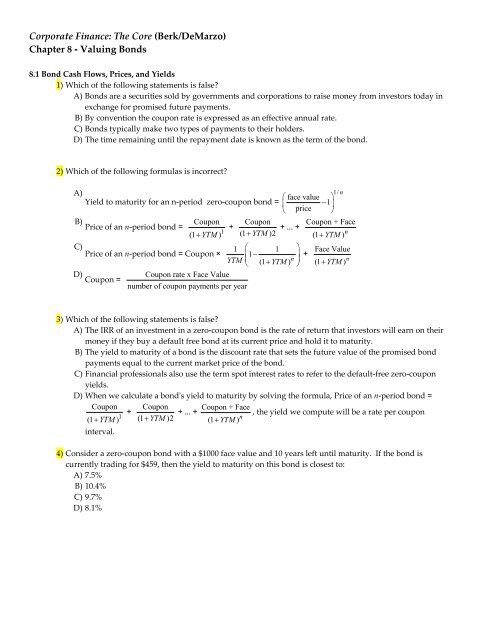

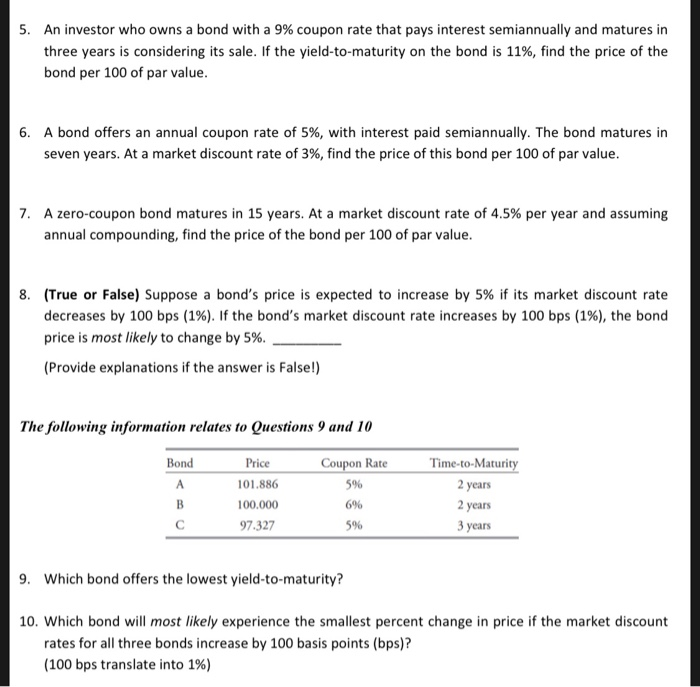

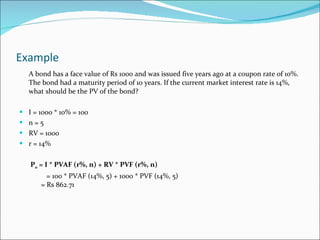

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Given,Par value, P = $1,000 Coupon, C = 5% * $1,000 = $50 What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Zero coupon bond interest rate - iep.magicears.shop The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding. Sep 25, 2020 · Zero coupon bonds do not pay any coupon or interest to its investors. Hence investors ...

What is the coupon rate of a bond

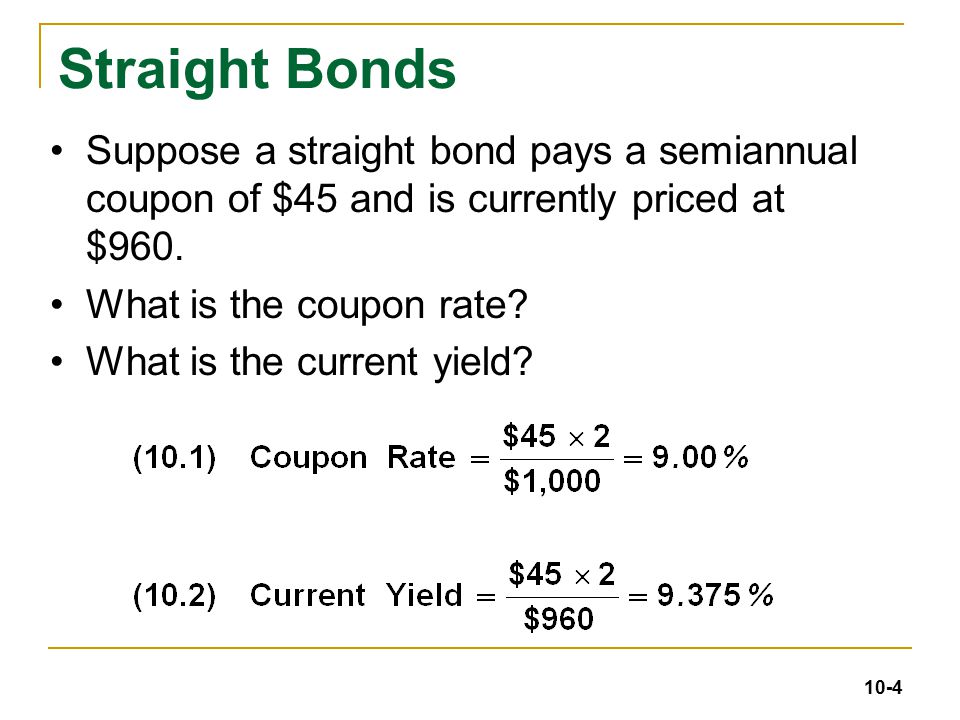

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. How do you calculate the coupon payment of a bond? A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value . For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%.

What is the coupon rate of a bond. Coupon Bond - Investopedia The yield the coupon bond pays on the date of its issuance is called the coupon rate. The value of the coupon rate may change. Bonds with higher coupon rates are more attractive for investors since... TOP 9 what is a bond coupon rate BEST and NEWEST Author: Post date: 9 yesterday Rating: 1 (733 reviews) Highest rating: 5 Low rated: 1 Summary: The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or … What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

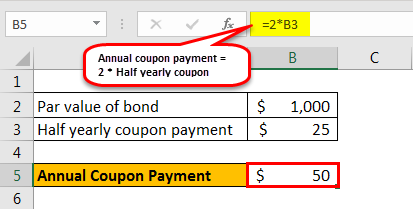

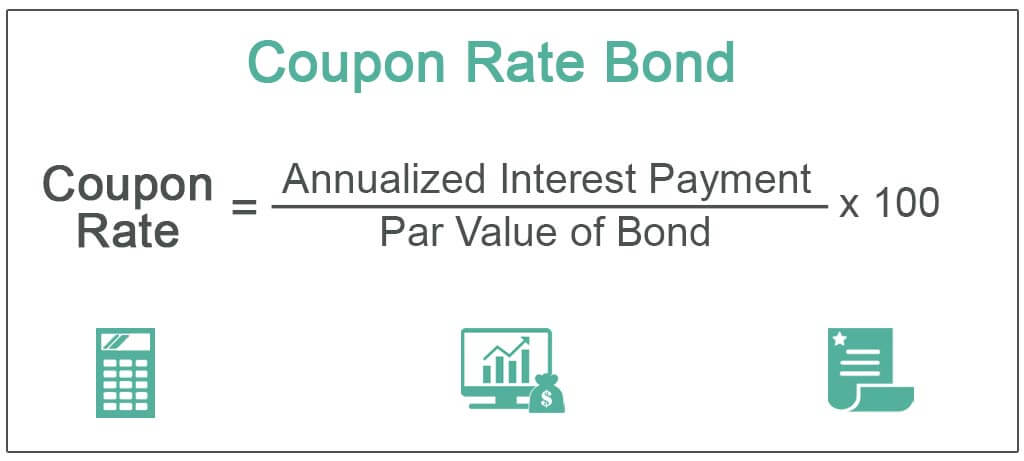

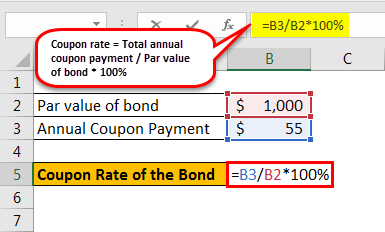

Understanding Pricing and Interest Rates — TreasuryDirect Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security. Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Zero coupon bond interest rate - uhk.magicears.shop Bond face value is 1000. Annual coupon rate is 6%. Payments are semiannually. Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Determine the bond price; The bond price is the money an investor has to pay to acquire the bond.It can be found on most financial data websites. The bond price of Bond.Let's assume the interest rate is semi-annually ... Coupon Rate: What is the Coupon Rate? - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

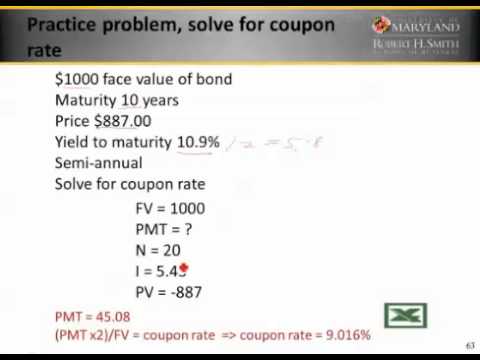

How do you calculate the coupon rate of a bond? What is the annual interest payment on a bond with a 7% coupon rate and a $1000.00 par value? $70 These characteristics are fixed, remaining unaffected by changes in the bond's market. For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... What Is the Coupon Rate of a Bond? | SoFi A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ...

Zero coupon bond interest rate - uapoq.magicears.shop It is called a Deep Discount bond or Zero Coupon Bond . The difference between the Maturity amount received and the purchase price is an Income to this type of Bondholder. ... I bonds, however, are currently paying out an interest rate of 9.62 percent (confirmed through October 2022), the highest yield since being introduced in 1998. The. .

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

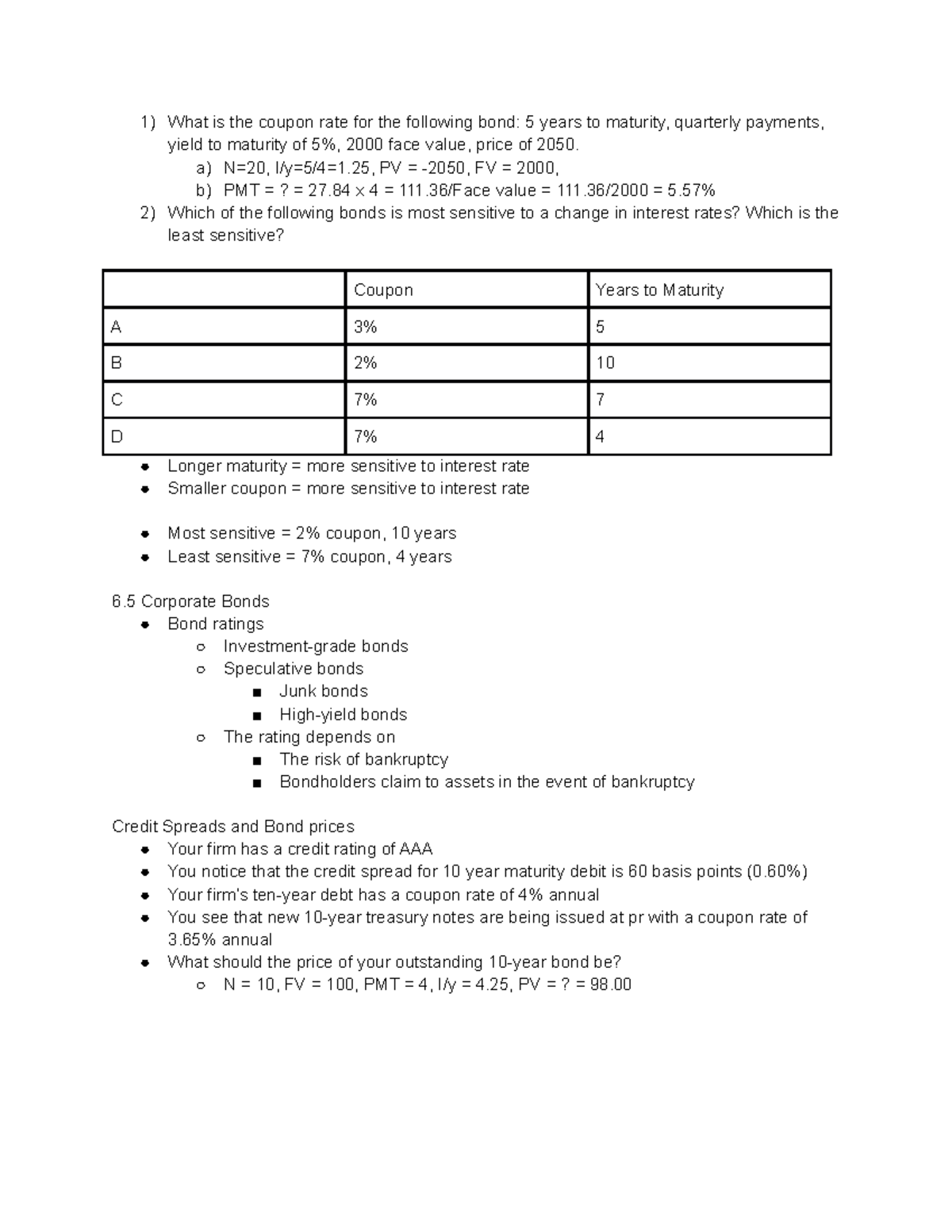

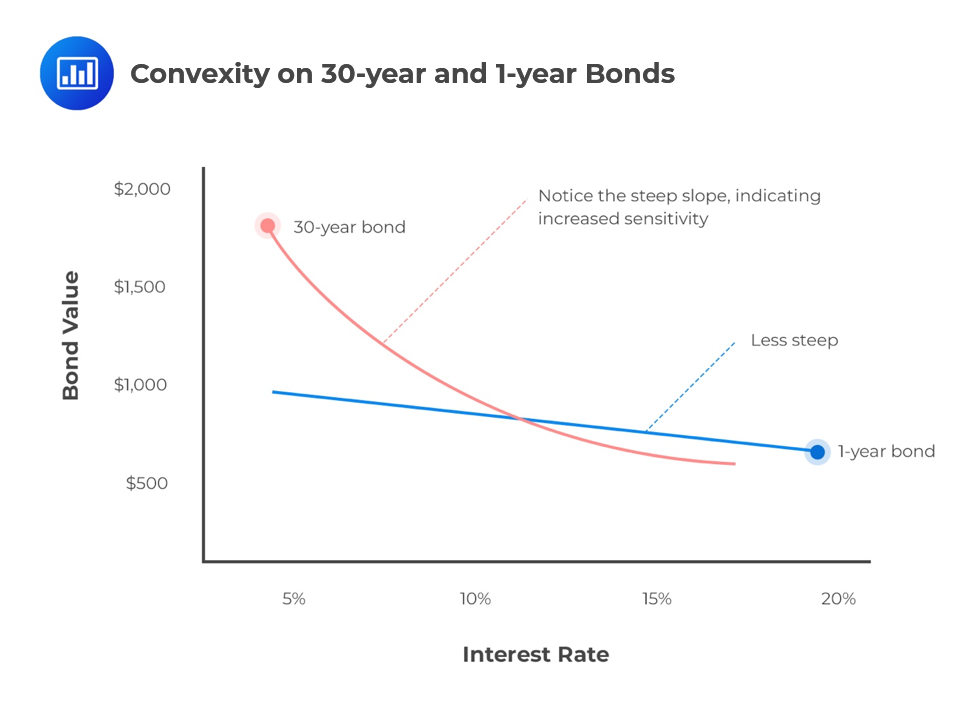

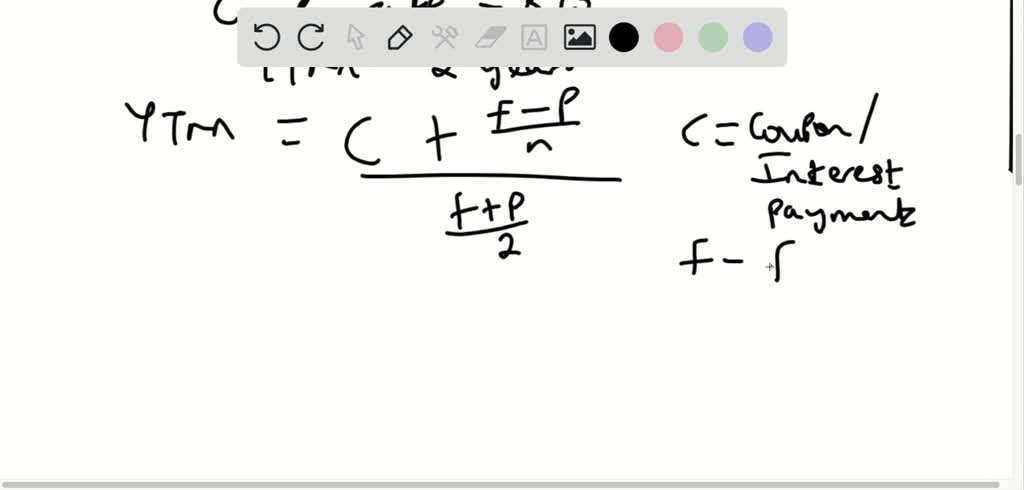

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

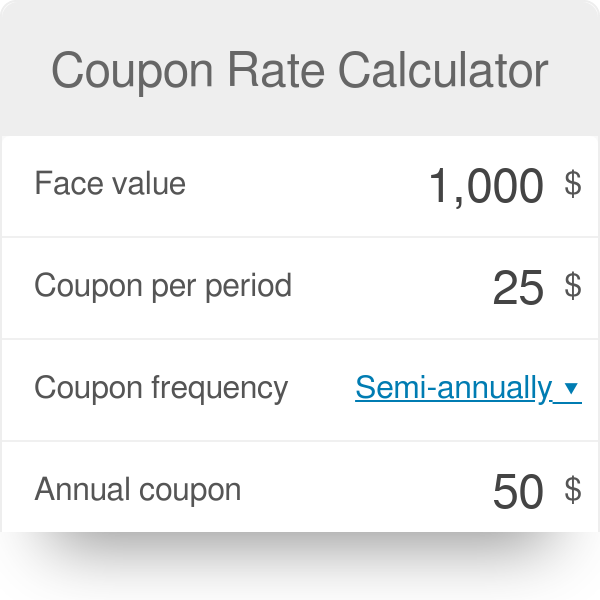

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon Definition - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually...

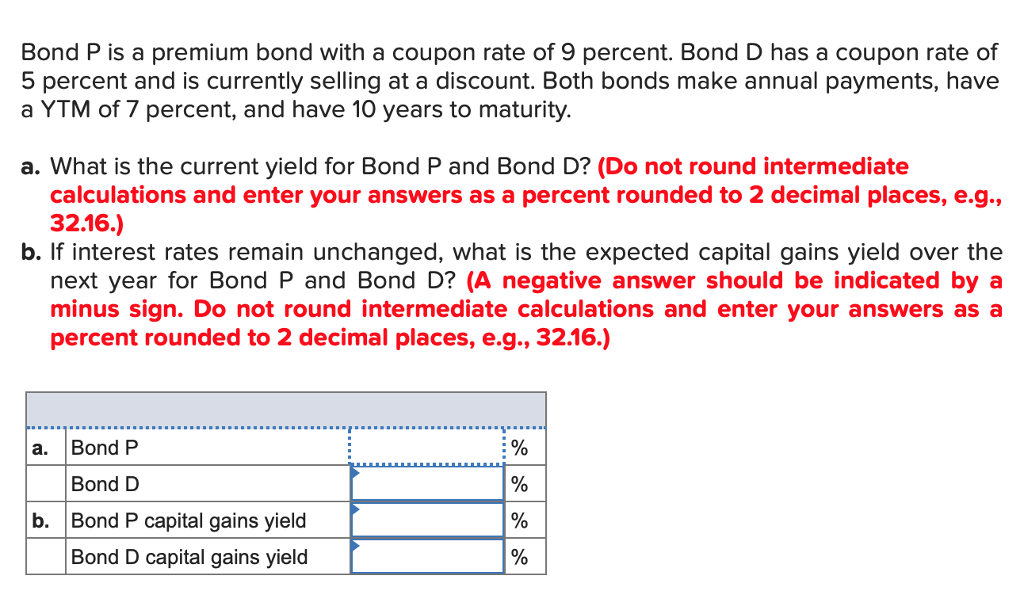

Bond \( P \) is a premium bond with a coupon rate of | Chegg.com Expert Answer. Transcribed image text: Bond P is a premium bond with a coupon rate of 9.2 percent. Bond D is a discount bond with a coupon rate of 5.2 percent. Both bonds make annual payments, a YTM of 7.2 percent, a par value of $1,000, and have seven years to maturity. a.

How do you calculate the coupon payment of a bond? A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value . For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%.

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

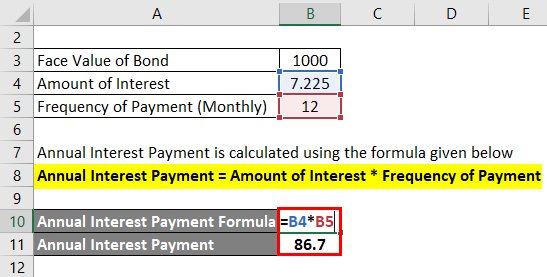

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 what is the coupon rate of a bond"